Business Insurance in and around Little Rock

One of Little Rock’s top choices for small business insurance.

Insure your business, intentionally

Your Search For Outstanding Small Business Insurance Ends Now.

Preparation is key for when something unavoidable happens on your business's property like an employee getting injured.

One of Little Rock’s top choices for small business insurance.

Insure your business, intentionally

Cover Your Business Assets

With State Farm small business insurance, you can give yourself more protection! State Farm agent Zach Johnson is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Zach Johnson can help you file your claim. Keep your business protected and growing strong with State Farm!

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Zach Johnson today to research your business insurance options!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

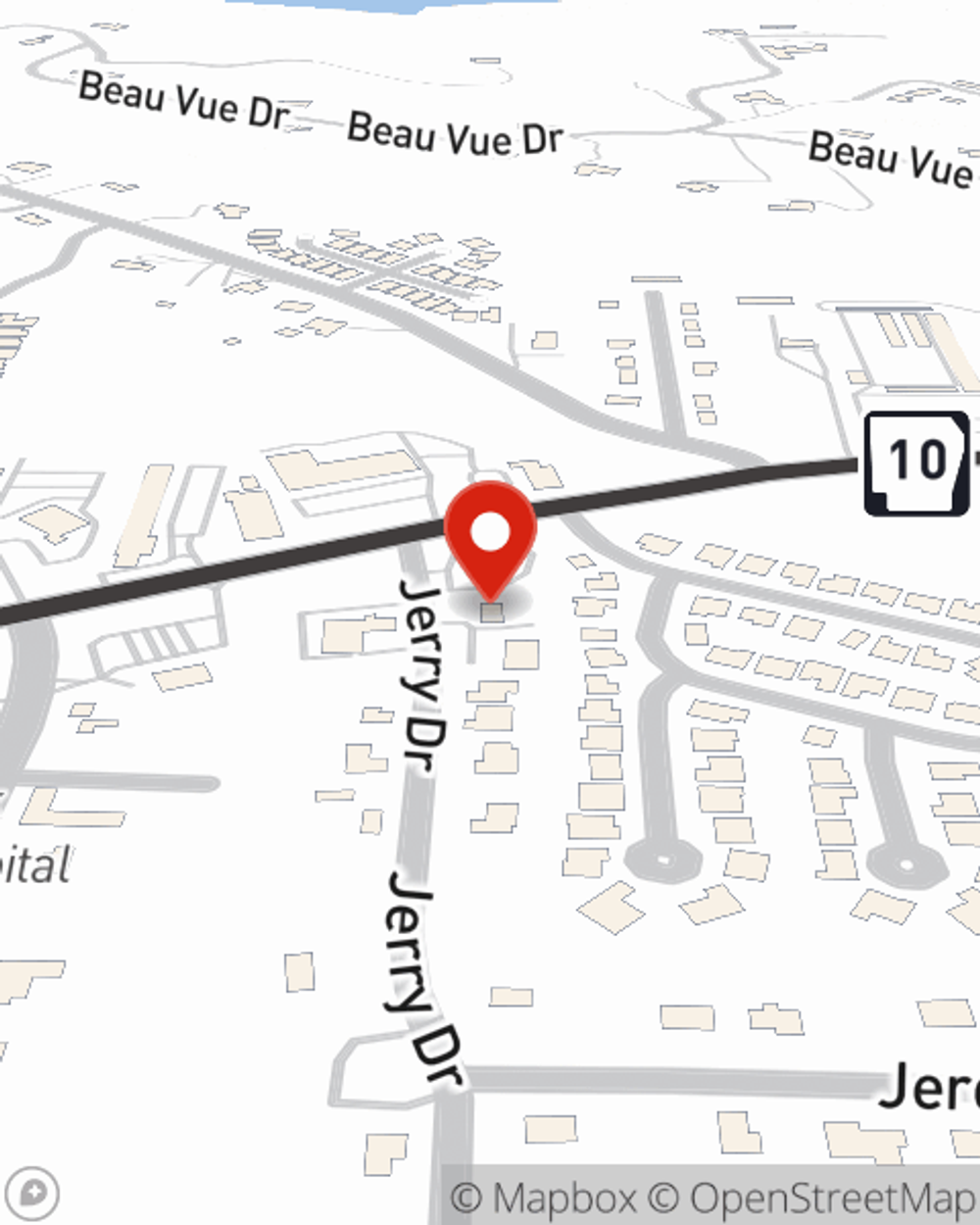

Zach Johnson

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.